Policymakers convinced holy grail of ‘immaculate disinflation’ within reach

[ad_1]

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening.

A flurry of dovish messages from central banks weighing the prospect of multiple interest rate cuts has set global stocks alight this week.

In contrast with past inflationary struggles, which have come at a heavy cost of recession and joblessness, today’s policymakers are increasingly convinced that the holy grail of “immaculate disinflation” — the vanquishing of inflation without driving up unemployment — is within reach.

A flurry of announcements began on Tuesday with the Bank of Japan ending a decade of ultra-loose monetary policy by calling time on negative interest rates. The FT editorial board praised the BoJ’s “prudent choreography” in signalling the move, but warned that the journey to normalising monetary policy remained “a long slog”.

The US Federal Reserve followed on Wednesday by holding rates steady at a 23-year high of 5.25 per cent to 5.5 per cent but confirmed that it expected to make 0.75 percentage points worth of rate cuts this year, signalling confidence that inflation was finally on the run. The news pushed Wall Street stocks to record highs, even if academic economists polled by the FT were a little more sceptical.

The Bank of England echoed the Fed on Thursday by keeping UK rates at 5.25 per cent but also signalled it was edging closer to cutting borrowing costs.

BoE governor Andrew Bailey said things were “moving in the right direction” and in an interview with the FT today confirmed rate cuts were “in play”. “The global shocks are unwinding and we are not seeing a lot of sticky persistence [in inflation] coming through at the moment,” he said. London stocks followed Wall Street’s trajectory, putting the FTSE 100 also on track for a record high.

Judging by today’s purchasing manager indices from S&P Global, UK business conditions are also looking more favourable, with services activity continuing to rise and the manufacturing downturn easing. The property market meanwhile is starting to factor in cuts in mortgage rates, while consumers’ confidence in their own finances has hit a two-year high.

Compared with the US and the UK, the path to rate cuts in Europe is a little less certain.

Although the PMI data for the eurozone tells a similar tale to that of the UK, European Central Bank chief Christine Lagarde said on Wednesday that high wage growth and weak productivity meant services inflation was proving stickier than expected. The ECB would need to continue checking that “incoming data supports our inflation outlook,” she argued.

Other key announcements came from Switzerland with a surprise quarter-point cut in rates to 1.5 per cent, making it the first central bank of a major western industrialised country to do so in the era of the post-pandemic inflation surge.

By contrast, Turkey, which is still scrambling to halt runaway inflation, surprised in the other direction with a 5 percentage point rise to 50 per cent.

For more on next steps for policymakers, premium subscribers can sign up here for the Chris Giles on Central Banks newsletter.

Need to know: UK and Europe economy

Consumer confidence may be rising for some, but for many British families the picture is very different: new government data showed the fastest rise in child poverty for 30 years, with 25 per cent of children living below the poverty line.

The UK is also facing a multibillion pound bill over pension inequality after an ombudsman said changes to the state retirement age for women were mishandled.

Simon Harris is set to become Ireland’s next Taoiseach (prime minister) after emerging as the sole candidate to succeed Leo Varadkar. In neighbouring Northern Ireland, Brexit is once again pulling parties apart.

Officials across Europe are warning of an “avalanche of disinformation” from Russia aimed at weakening support for Ukraine and interfering with EU elections in June.

Need to know: global economy

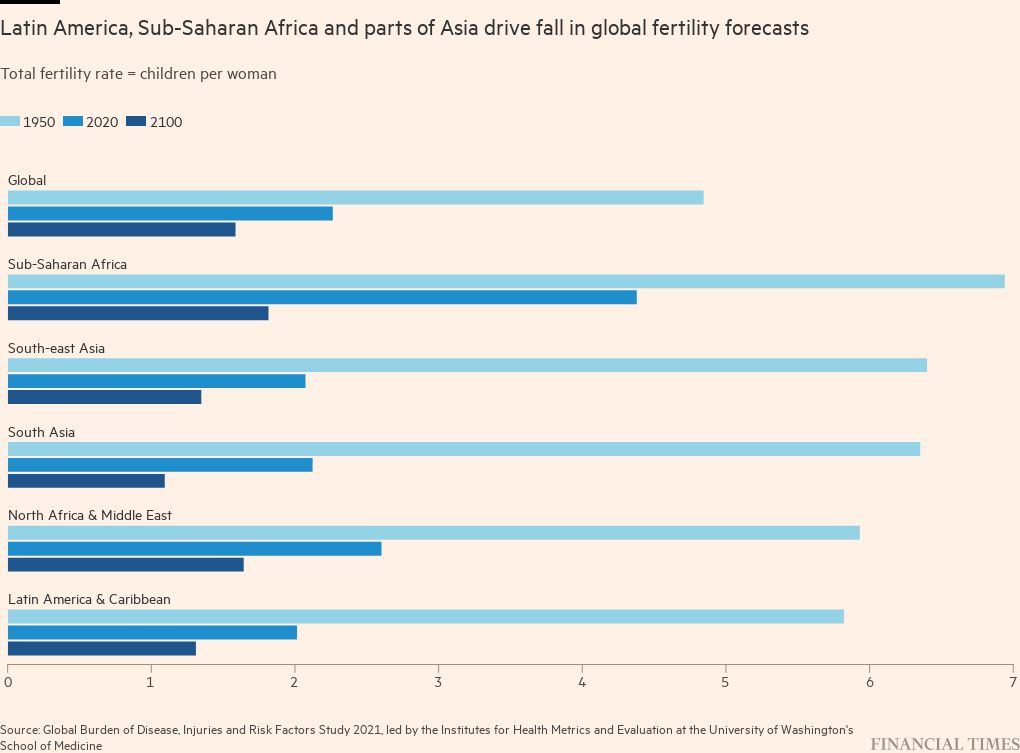

Falling fertility rates over the next quarter century are likely to have a far-reaching effect on the global economy, according to a new study. Three-quarters of nations are set to fall below population replacement birth rates by 2050, leaving growth to a few poorer states in sub-Saharan Africa and Asia that face severe threats from resource shortages and climate change.

Argentina’s new president Javier Milei has launched an aggressive campaign to transform state-owned companies as politicians in Congress hold back his plans to privatise them. Cost cuts have also opened up fierce conflicts with staff and unions.

Global business chiefs are gathering in Beijing for the China Development Forum — aka “China’s Davos” — amid concerns that the country’s industrial oversupply in sectors such as steel could become a “slow-motion train accident” for world trade.

It’s no longer the economy, stupid. The age-old relationship between economic sentiment and a government’s popularity has disappeared in the US, but remains as strong ever in western Europe, says chief data reporter John Burn-Murdoch.

Need to know: business

In a landmark antitrust case, the US is suing Apple for allegedly building a smartphone market monopoly, accusing the group of imposing contractual limitations on developers while making it more difficult for users to switch devices. The move is a watershed moment for the company, now in the crosshairs of regulators on both sides of the Atlantic.

Shares in social media company Reddit surged by 48 per cent on its market debut, in a vote of confidence for initial public offerings after two years of subdued activity. It also marks a turning point for a fringe, free-speech orientated platform as it transforms into a more mainstream discussion site.

The FT revealed that the BBC is building its own artificial intelligence models while also holding talks over selling access to the broadcaster’s vast archive to Big Tech groups including Amazon. A new Big Read examines how the bidding war for AI talent is leading to ever greater concentration of power in Big Tech.

Shares in clothing retailer Next — seen as a bellwether for UK consumer demand — hit a record as it forecast £1bn in profits this year. The company has responded well to the shift to online and global crises, unlike many middle market rivals.

Science round-up

The World Meteorological Organization sounded a “red alert” on the impact of climate change after 2023 was affirmed as the hottest year on record. The WMO highlighted rising food insecurity and a large gap in funding necessary to mitigate the changes. Methane emissions, much more potent than those from carbon dioxide, are creeping up the agenda after a series of large leaks.

Scientists are getting closer to nuclear power’s dream: fusion reactors. Read more in our special report: Nuclear Energy

Space agencies are racing to find water on the moon, essential for the establishment of lunar settlements. Read more in our special report: The Future of Water.

A dispute among World Health Organization members over a genomic databank threatens to unravel a global pandemic accord and hinder vaccine development.

A new gene therapy to treat a rare genetic disease that attacks the central nervous system of young children became the most expensive drug in history, priced at $4.25mn in the US.

Gene-editing pioneer Jennifer Doudna meanwhile called for therapies to be made available for all through increased investment in Crispr technology. The UK in November gave the world’s first regulatory approval for a Crispr treatment.

Some good news

An app from a Spanish tech company is helping visually impaired travellers across the world navigate urban transport systems.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link