Cencora Remains Chronically Undervalued, With Material Growth Potential (NYSE:COR)

[ad_1]

JHVEPhoto/iStock Editorial via Getty Images

Cencora (NYSE:COR)- formerly AmerisourceBergen- is a Conshohocken, Pennsylvania-based drug wholesaler and contract research company with operations across a broad portfolio of specialties, primarily across the US but with a growing international presence.

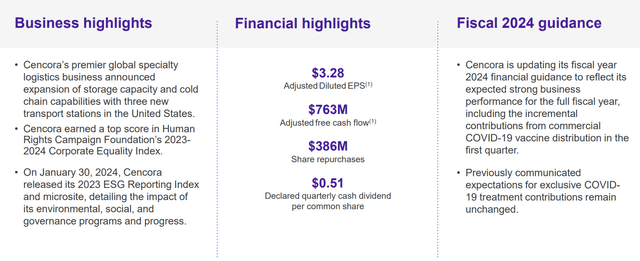

Cencora Q1 F24 Earnings Presentation

Through these activities, over the past quarter, Cencora has achieved a total revenue of $72.25bn- a 14.97% YoY increase- alongside a net income of $601.50mn- a 25.38% increase- and a free cash flow of $810.94mn- a 27.84% increase driven by rising cash flow across operations, investments, and financing.

Introduction

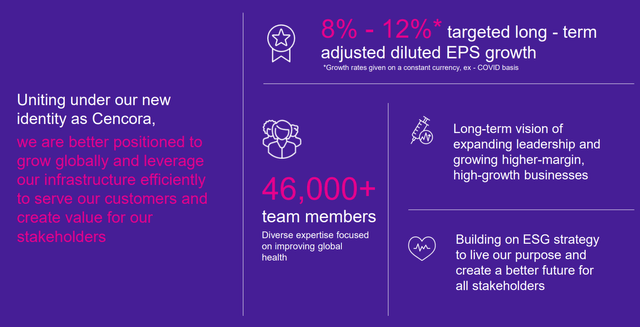

Regardless of being named Cencora or AmerisourceBergen, the firm’s broad ambitions remain the same; Cencora aims to produce an 8%-12% EPS consistently over the long term by essentially becoming the underlying healthcare infrastructure for all manner of institutions and organizations. Through this, Cencora vies to expand its leadership in the healthcare wholesaler and distribution business, supporting higher margins and growth.

Cencora Q1 F24 Earnings Presentation

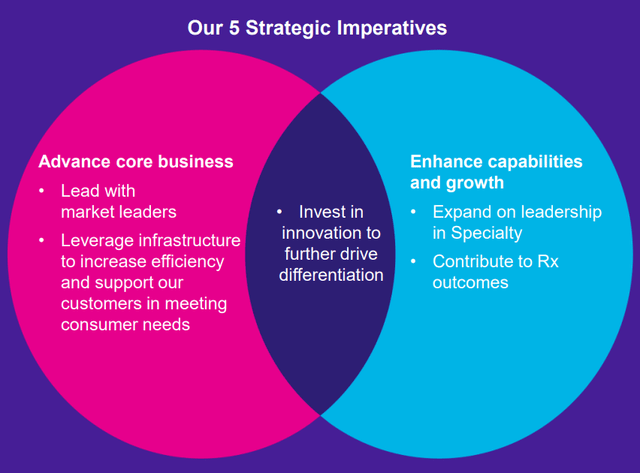

To do so, Cencora has outlined a fivefold list of strategic imperatives, advancing their core businesses by investing in margin-enhancing, segment-leading businesses and leveraging extant infrastructure to increase cost efficiency in supporting consumers. The firm also aims to enhance its general capabilities, both through strategic M&A and in-house investment to support expanded leadership opportunities in Specialty categories and to contribute to more positive pharmaceutical outcomes. Tying it all together, Cencora is investing heavily to support innovation, both reducing costs and expanding opportunities.

Cencora Q1 F24 Earnings Presentation

In my previous article, I focused on Cencora’s positioning to take advantage of longer-term, macro factors, such as an aging US population. While Cencora’s advantages in this context remain, this article focuses more so Cencora’s evolving role as a more holistic healthcare infrastructure company, citing its positioning in the healthcare market, investments in areas across the healthcare value chain, and external investment activities to acquire leadership and specialties.

Due to the latter, in addition to a general undervaluation, I rate Cencora a ‘buy’- in the long term. In the short-term, the company behaves too much like a ‘value trap’ and has much-associated risk.

Valuation & Financials

Trailing Year Price Action

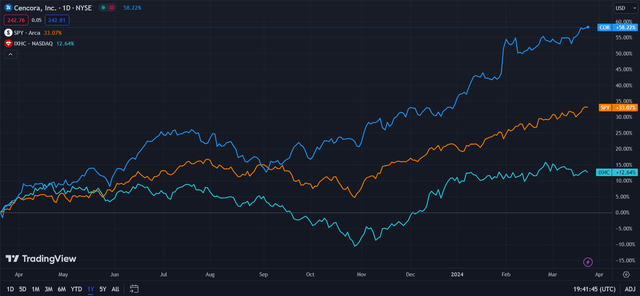

In the TTM period, Cencora’s stock- up 58.22%- has outperformed both the healthcare industry, as represented by the NASDAQ Health Care Index (IXHC)- up 12.64%- and the broader market, as represented by the S&P 500 (SPY)- up 33.07%.

Cencora (Dark Blue) vs Industry and Market (TradingView)

While healthcare stocks have lagged the market due to an array of factors, such as tighter monetary conditions worsening the conditions for investment in novel medtech or pharmaceutical pipelines, Cencora has demonstrated extraordinary resilience, beating earnings and outperforming operationally.

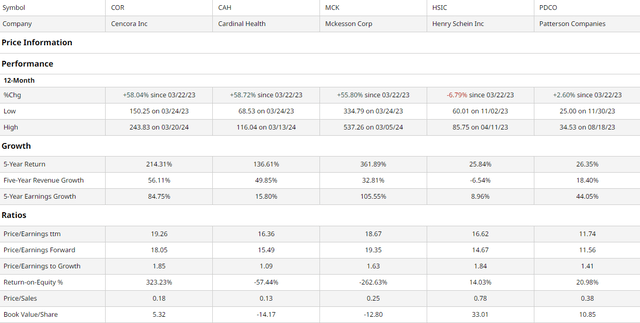

Comparable Companies

The strategic advantage underlying Cencora and such business remains the sheer scale at which they operate. As such, there is a limited number of pure competitors or peers to which Cencora can be compared and I sought to compare Cencora to companies of similar operations. This group includes the Dublin, Ohio-based largest radiopharmacy operator in the US, Cardinal Health (CAH), the Irving, Texas-based medical and healthcare distributor, McKesson Corporation (MCK), and smaller competitors such as the Melville, New York-based health distributor, Henry Schein (HSIC) and the dental focused, Mendota Heights, Minnesota, Patterson Companies (PDCO).

As demonstrated above, Cencora has seen the joint-highest TTM price action alongside Cardinal Health. Despite this growth, I believe Cencora is best positioned to achieve growth among the peer group, owing to decent multiples and strong growth metrics.

For example, although Cencora maintains the highest trailing and forward P/E ratios alongside the highest PEG, the company sustains the second-lowest P/S ratio and third-highest BV/share of the group, representing the scale strength of the firm.

More bullish is the firm’s growth prospects; Cencora records the highest trailing five-year revenue growth and second-highest earnings growth, driving the company’s second-greatest returns. Moreover, Cencora retains a peerless ROE at 323.23%.

Valuation

According to my discounted cash flow model, at its base case, the net present value of Cencora is $254.64, up from a current price of $242.50, representing a ~5% undervaluation.

My valuation, calculated over 5 years without perpetual growth built-in, assumes a discount rate of ~9%, reflective of Finbox’s medium estimate of Cencora’s WACC and balances the lower equity risk of the stock with its higher debt volume. Additionally, remaining conservative and discounting the increased revenue driven by COVID-19, I estimated the forward 5Y revenue growth rate to be 7%, down from the trailing arithmetic growth rate of 9.35%.

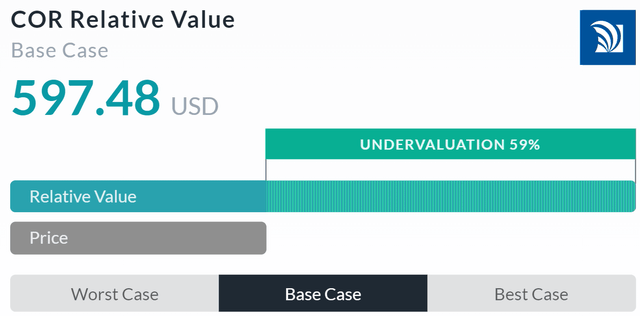

On the other hand, Alpha Spread’s relative valuation tool believes Cencora is undervalued by a much greater margin. However, Alpha Spread, on its page about Cencora, cites the stock to potentially be a value trap and valued much higher than its true value. Combining the latter with Alpha Spread’s tendency to ignore outlier equities it may be comparing Cencora to, we can conclude Alpha Spread’s model to be overestimating Cencora’s value.

However, this does not mean Alpha Spread’s model is not correct in its direction.

As such, assigning Alpha Spread a 10% weight and my DCF a 90% weight, the fair value of Cencora should be ~$288.92, representing a ~10.40% undervaluation.

Cencora is Committed to the Growth of Margin-Expanding Segments

Among the foremost theses for Cencora in the long term remains its positioning along the healthcare value chain. Cencora situates itself as the distributor and ancillary solutions provider both to healthcare providers such as pharmacies and hospitals and to biopharma manufacturers. The company can leverage its scale to ensure fair pricing for providers and fair compensation for biopharma manufacturers while collecting the spread; while this model has its flaws- namely the lower margins involved- Cencora is rooted in its position and can continue to collect the spread with scale.

Cencora JPMorgan Healthcare Conference 2024

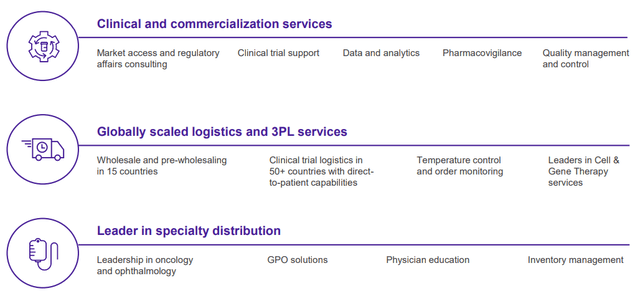

Beyond this dichotomy, however, is where Cencora’s growth story accelerates; Cencora has invested in greater clinical and associated commercialization services, providing tools and consultancy to support clinical work. Additionally, the firm has expanded its geographic positioning, supporting greater scale and cost-base management. Staying within the theme of padding margins, Cencora’s leadership in specialty distribution- a higher margin market due to the barriers involved- supports this theme.

Cencora JPMorgan Healthcare Conference 2024

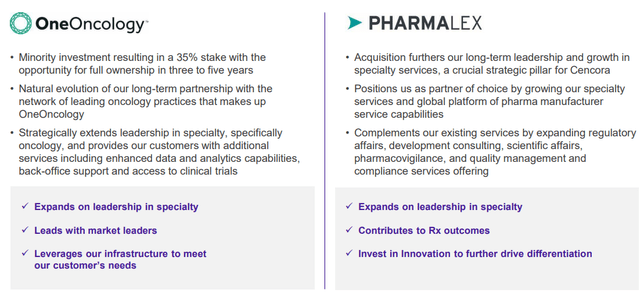

Externally, Cencora has committed to financially sustainable investments, aiming to partner with firms in margin-expanding projects novel to the company. For instance, in FY23, Cencora made a 35% minority investment in OneOncology, expanding Cencora’s footprint in one of the leading oncology practices which are components of OneOncology. Similarly, expanding Cencora’s presence in specialty and manufacturing pharma, Cencora acquired PharmaLex.

Cencora JPMorgan Healthcare Conference 2024

Wall Street Consensus

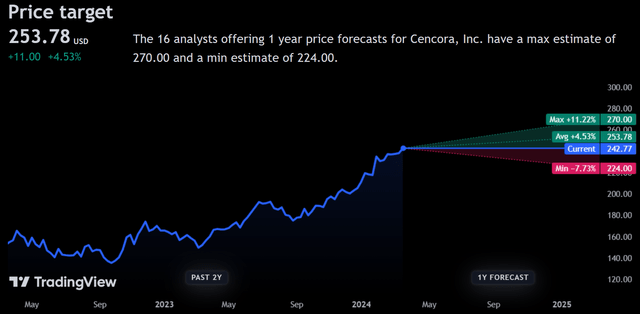

Analysts generally echo my positive view on Cencora, estimating an average price target of $253.78, a 4.53% increase.

Even at the minimum projected price, analysts only see a net decline of ~7% net of dividends, a relatively small decrease relative to potential and historic growth.

I believe this indicates analyst sentiment on the resilience and low equity risk of the stock, which is a theme I have also touched upon.

Risks & Challenges

Cencora Runs the Risk of Continuing Chronic Underperformance

While Cencora is moderately undervalued, maintains a strong moat, and has a growth-oriented operational strategy, the firm’s high relative leverage and the regulatory complexity it operates within may inhibit this growth and thus the ability to meet its value. Therefore, the aforementioned ‘value trap’ aspect of the stock may come into play, with Cencora potentially facing laggard growth.

Falling Rates May Harm Risk-Adjusted Attractiveness of Stock

While most of the healthcare industry performed poorly over the past year, Cencora was able to outperform, operating in a niche with inelastic demand- healthcare and pharmaceuticals- and in a position with a strong moat. As such, to investors, Cencora was relatively more attractive given the lower prices of equities depressed by higher rates. As rates are expected to come down later this year or early next year, Cencora may lose this advantage and become less attractive on a risk-adjusted basis.

Conclusion

Looking forward, Cencora will retain its defensible position along the healthcare value chain but accelerate growth through its presence in specialty pharmaceuticals and beyond.

[ad_2]

Source link