Will Xi’s manufacturing plan be enough to rescue China’s economy?

[ad_1]

As Xi Jinping toured China’s central Hunan province last week, local officials were called forward to inform the nation’s powerful leader on their plans to accelerate the development of “new quality productive forces”.

The slogan, rooted in 19th-century Marxist thinking, has in early 2024 become shorthand for Xi’s vision of economic growth underpinned by China’s increasingly advanced manufacturing industries.

This month the phrase was used nine times in a 6,000-word essay published by state news agency Xinhua, which also elevated the importance of Xi’s economic reform programme to that of Deng Xiaoping, who many regard as the architect of modern China. It was also listed as the government’s top economic priority for 2024 by Xi’s number two, Premier Li Qiang, when he confirmed China’s economic growth target of around 5 per cent earlier in March.

He Shujing, an analyst with Beijing advisory group Plenum China, says the emergence of the term is “a clear signal that China’s top leaders believe that the country needs to enter a new stage of structural transformation”. The requirement to adopt a “new path” of original innovation is a departure from its previous path of technological advancement through emulation, she adds.

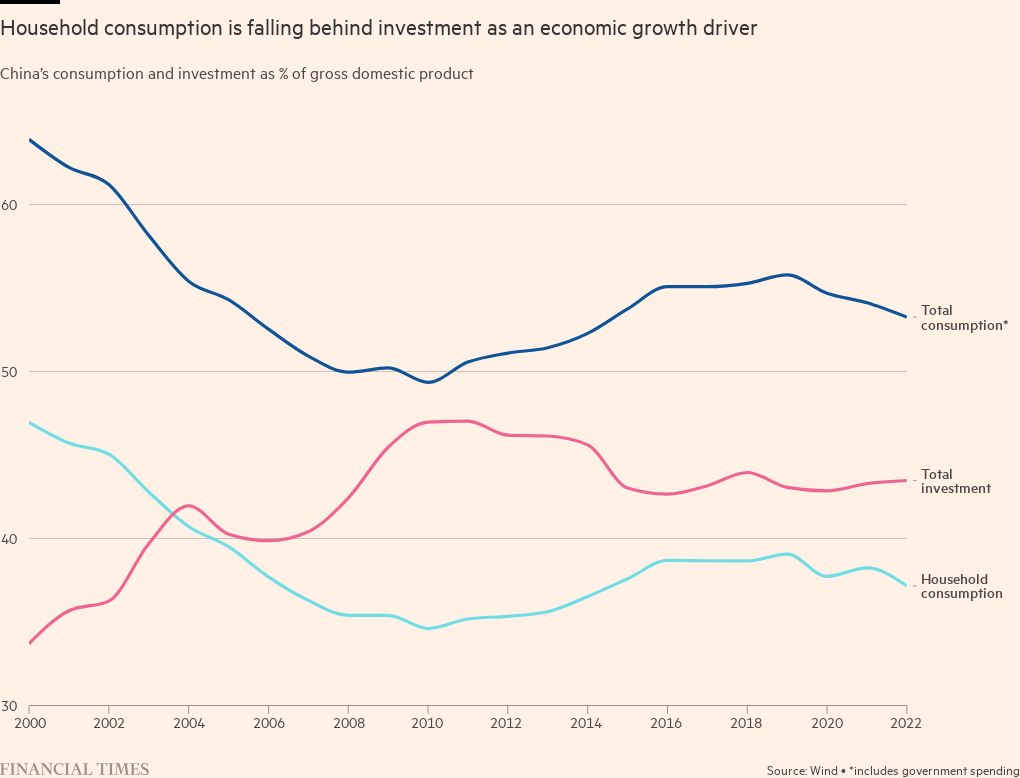

However, Xi’s pivot towards high-technology manufacturing, rather than relying on incentives to boost consumer-led growth, is drawing scrutiny at home and abroad.

Economic growth has slowed since the pandemic, the country’s 1.4bn citizens are hoarding savings rather than spending and foreign direct investment has waned. That weak domestic demand has raised fears that many of the high-tech products Xi espouses will end up being dumped on to export markets.

“For this to work, China must expand its share of global manufacturing. That needs to be accommodated by the rest of the world. The rest of the world is unlikely to do that,” says Michael Pettis, a finance professor at Peking University and senior fellow at think-tank Carnegie China.

Xi’s administration has won praise for finally calling time on the unsustainable build-up of trillions of dollars in debt by China’s real estate developers and most of its provincial governments.

But his administration’s failure to find new consumer-focused drivers of economic growth has raised more fundamental questions about the economic direction chosen by the country’s most powerful leader since Mao Zedong.

Never in the post-Mao era has the Chinese Communist party pursued a growth path where property and infrastructure were not among the leading drivers of investment, economists say. Nor has a major modern global economy ever orchestrated a soft landing from decades of debt-fuelled growth without providing significant support for households and consumers.

Twelve years into his leadership, Xi appears clear-eyed about the challenge as he steers the world’s second-biggest economy into uncharted territory.

“This is an unprecedented path, but we will continue to explore it and forge ahead with courage,” he was quoted by state media as saying.

China, experts say, is an outlier when it comes to the proportion of economic growth it derives from investment.

According to World Bank data, investment as a percentage of global gross domestic product has for decades hovered around 25 per cent. In high-investing countries, usually in the developing world, it generally varies between 30 and 34 per cent. In China, it has held above 40 per cent for two decades, Pettis points out.

About two-thirds of that investment has gone into property and infrastructure. But while these remain big parts of the Chinese economy, they are no longer expected to underpin growth.

In 2021, in what is now regarded as a landmark moment, Beijing imposed its “three red lines” on real estate companies to address skyrocketing leverage in the property sector. Housing is for living, Xi declared, not for speculation.

Three years later, there is mounting evidence that similar treatment is being meted out to those provincial and local governments that spend unsustainable amounts on unproductive infrastructure.

According to a document viewed by the FT, the State Council, China’s cabinet, has barred 10 debt-laden provinces and regions and two big cities from building highways, government buildings and other new projects. A further 19 regions have been encouraged to report their most indebted cities, so the central government can work out further debt reduction plans.

The local government in Yunnan, a province in China’s south-west, has halted expenditure on more than 1,500 infrastructure projects, according to another document seen by the FT. And this month four cities, including Harbin, the capital of China’s northernmost province, were told to cut back on underground rail construction.

Bloomberg estimates that as of the end of 2022, property developers owed Rmb17.8tn ($2.5tn) while local government financing vehicles owed Rmb94tn, according to Goldman Sachs. The workout of this debt is expected to take years, if not longer.

But Pettis says Beijing’s attempts to address its “two big problem areas” should ultimately be positive for China. “Reining them in, by definition, means a sharp reduction in economic activity,” he says. “It is a good thing in the medium and long term because it is unsustainable and [curtailing] it is the only way to bring debt under control.”

One of the most important questions for China now, economists say, is to what extent manufacturing can fill the gap that the de-prioritisation of real estate and infrastructure has created.

In recounting Xi Jinping’s foresight as an economic planner, the Xinhua essay pointed as far back as Mao’s cultural revolution. In the 1970s, a teenage Xi led the development of biogas-generating facilities in a rural village, replacing burning wood for lighting and cooking — an early example, it said, of leveraging “new quality productive forces”.

Among such forces today, according to Premier Li, are the “new trio” of electric vehicles, lithium-ion batteries and solar photovoltaic cells. Exports of these items rose 30 per cent to $147bn last year, according to official customs data.

China’s factories already account for about 28 per cent of GDP, compared with a global average of 16 per cent, according to World Bank data. Much of their output has historically been lower-value exports in electronics and machinery.

But China is becoming increasingly competitive, and in some cases dominant, across numerous advanced technologies including wind turbines and battery materials. It is fast catching up in computer chips, artificial intelligence and autonomous vehicles and targeting nuclear fusion, quantum computing, hydrogen, spacecraft and biomanufacturing.

While experts are mindful of the opacity surrounding Beijing’s plans — no national-level targets have been set for future-orientated industries — there is little doubt that an important change is under way. They also point out that it aligns with Xi’s overarching aims of technological self-reliance and resource independence for China.

“Xi seeks to strengthen China’s economic strength through innovation by any means necessary and to reduce its economic vulnerability to potential western sanctions,” say Olivia Cheung and Professor Steve Tsang, academics at Soas University of London, in their book The Political Thought of Xi Jinping.

In Beijing, economic planners argue that they are trying to avoid repeating the same mistakes that led to the crippling debts linked to property and infrastructure development.

Officials at the People’s Bank of China point to more central oversight as the state’s financial resources are reallocated towards bolstering credit for the key emerging and strategic sectors.

The PBoC is drawing up plans to establish a new credit market department, which aims to direct the country’s vast Rmb450tn banking sector to finance priority areas.

Official data suggests that the shift is already taking shape. Pan Gongsheng, governor of the PBoC, said in January that growth rates for green loans, short-term technology loans, and long-term manufacturing loans significantly outpaced overall lending growth in 2023. Meanwhile demand for loans in the real estate sector and from local government financing vehicles have fallen drastically in recent years.

Beyond China’s shores, many experts and government officials view the prospect of Beijing’s increased reliance on manufacturing for growth as an emerging threat.

Comparisons of industrial policy are notoriously difficult. But the Center for Strategic and International Studies describes Chinese state support as “uniquely high”, estimating it at $406bn, or 1.73 per cent of GDP, in 2019. That compares to 0.39 per cent of GDP in the US and 0.5 per cent in Japan.

In the US and Europe, politicians fear that such heavy spending will result in a wave of low cost high-tech exports from China that could displace domestic industries and pose risks around national security.

Washington and Brussels have launched separate investigations into China’s electric vehicle industry, the former targeting security risk to Americans, the latter over allegations of unfair state support.

President Joe Biden has also recently promised billions of dollars to replace Chinese-made container cranes in US ports, citing concerns hackers could disrupt supply chains.

After meeting Xi and Li in Beijing in December, European Commission president Ursula von der Leyen noted the EU’s trade deficit with China had ballooned to €400bn, from €40bn 20 years ago, as she highlighted a series of complaints including China’s industrial overcapacity. “European leaders will not be able to tolerate that our industrial base is undermined by unfair competition,” she said.

In private conversations with their Chinese counterparts, American economic officials have warned Beijing that the US and its allies will take action if China tries to ease its industrial overcapacity problem by dumping goods on international markets.

David Skilling, director of research at advisory firm Landfall Strategy Group, says “the absorptive capacity of the global economy is limited” and warns that “there’s going to be some real geopolitical blowback” from China’s expansion of high-tech manufacturing.

Beijing has made some moves to allay international concerns. Xuan Changneng, a PBoC vice governor, told a briefing last week that the central bank will also be careful to guide banks against excessive lending that might drive overcapacity problems.

That came weeks after China’s commerce ministry and eight other agencies in February announced plans to support the “healthy development” of the country’s overseas EV expansion, including co-operating more with foreign partners and utilising free trade deals.

Against the backdrop of rising international concern, experts believe the manufacturing strategy will not deliver on Beijing’s growth targets. Exports already account for a fifth of GDP and China’s share of global manufacturing stands at 31 per cent. Absent an explosion of demand, they say it is unlikely the rest of the world could soak up China’s exports without shrinking its own manufacturing.

Skilling says China will not be able pursue these policies “indefinitely” and notes that export flows are already shifting towards economies that are more geopolitically “friendly”, including other members of the Brics grouping, the Association of Southeast Asian Nations, Latin America, and Africa. But developing economies cannot compensate for reduced access to advanced economies.

Nor do they want to see their own domestic industries displaced by Chinese rivals. Brazil’s industry ministry has in the past six months opened at least half a dozen probes into alleged dumping of products from China’s manufacturing industries, ranging from metal sheets and pre-painted steel to chemicals and tyres.

Vietnam, an increasingly important global manufacturing base, is investigating allegedly unfair exports of Chinese-made towers for wind turbines. Thailand has accused China of evading anti-dumping duties and Chinese companies have also been hit by increased tariffs on scores of products exported to Mexico.

In a rare display of domestic policy criticism, two prominent Peking University economists, Huang Yiping and Lu Feng, this month sounded warnings over Beijing’s plans. “There are many criticisms pointing to our overcapacity since February, and suggesting that our industrial policies could impact the international trade order,” said Huang, a professor of economics, in a recent forum.

“We need to take this [criticism] seriously. If a protectionist wave against Chinese products gained momentum around the globe, then it would be detrimental to our development in the next phase, especially in innovation,” Huang added.

Another China-based economist, who asked not to be named, says that Huang and Lu “gingerly danced around” the problem. “They should have been much tougher and said ‘this isn’t going to work, you can do that when you are small but you can’t do that when you are big’,” the person says. “This should have been obvious.”

China’s pivot to high-tech manufacturing comes at a delicate moment for its economy. Since the lifting of strict pandemic restrictions in late 2022, financial markets have clamoured for some kind of consumer-focused stimulus to help boost growth.

Illustrating the persistent anxiety among ordinary Chinese about their future, household savings remain at record highs of $19.3tn more than a year after the removal of coronavirus controls. Lacklustre consumer demand has pushed prices into deflation.

Investors remain cautious. Foreign direct investment has fallen to its lowest level in absolute terms since 1993, when the reformist leader Deng was in charge. China’s benchmark stock index, the CSI 300, has lost 32 per cent since the start of 2021; America’s S&P 500 has gained 39 per cent in the same period.

Confidence, experts say, has not recovered after years of crackdowns on everything from high-flying business leaders and fast-growing consumer technologies to the publication of economic data and opinions that contradict the official narrative.

According to one senior Chinese economic adviser, who asked not to be named, policymakers in Beijing are resisting the stimulus button because they fear another years-long credit boom.

“All of the past reforms and deleveraging efforts will be in vain . . . They believe they are still handling the painful after-effects of the last round of stimulus, post-2008,” he says. “Plus, the demand side of consumption is something that can’t be easily stimulated while confidence remains weak.”

Cheung at Soas argues that Beijing’s plans need to be viewed in the context of Xi’s focus on supporting industries that first help national security and second can be harnessed “to make China great”.

She says the plan makes sense in terms of Xi’s ideology and his aims for regime stability and national security. But failure would risk making China a less consequential global economy.

“The long-term goal is a world economic order that really favours China,” she says. “We are just at the very beginning.”

Data visualisation by Andy Lin

[ad_2]

Source link