S&P 500 Gains and Losses Today: Solar Stocks Shine, Shaking Off Recent Slump

[ad_1]

:max_bytes(150000):strip_icc():format(jpeg)/latestGainersLosers-62573e957e2a48299abcc1f6b9616b13.png)

Key Takeaways

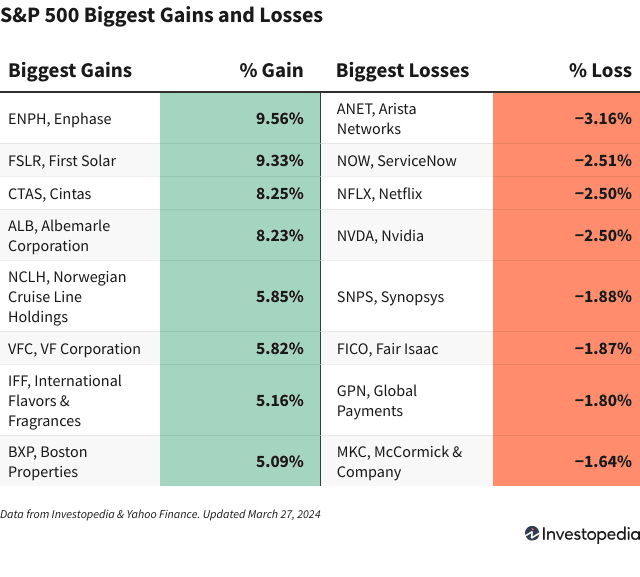

- The S&P 500 added 0.9% on Wednesday, March 27, 2024, logging its first positive day after three consecutive losing sessions.

- Solar stocks posted solid daily gains, with shares of Enphase Energy and First Solar pushing higher.

- Shares of networking equipment provider Arista Networks tumbled amid reports that its founder has agreed to settle insider trading charges.

The S&P 500 moved 0.9% higher, logging its first positive trading day since jumping to an all-time closing high last Thursday.

Other major U.S. equities indexes also advanced on the day, with the Dow and the Nasdaq adding 1.2% and 0.5%, respectively. The daily gains came despite underperformance from the technology and the communication services sectors, which have played a key role in underpinning the market’s rally in early 2024.

Shares of solar technology company Enphase Energy (ENPH) led the S&P 500 higher, soaring 9.6%. Heading into Wednesday’s session, Enphase shares were down roughly 18% year to date amid sluggish demand for solar equipment. However, the company expects demand to recover in Europe during the later part of the year, and it could see a boost from its energy monitoring and distribution services.

Enphase was not the only bright spot in the solar industry. Shares of photovoltaic (PV) solar solutions provider First Solar (FSLR) jumped 9.3%. First Solar faces similar headwinds related to high interest rates and slumping demand and the company is positioned to benefit from tax credits.

Cintas (CTAS) shares added 8.3% after the provider of workplace equipment and cleaning supplies reported better-than-expected quarterly results and boosted its full-year guidance. Mandates for remote workers to return to the office have helped lift demand for the company’s uniforms and business services.

Shares of Albemarle (ALB), the world’s largest lithium producer, advanced 8.2% following news that Chile’s government has opened additional lithium-rich salt flats to private investment. The South American country is home to the second-largest lithium industry in the world after Australia.

Arista Networks (ANET) shares posted the steepest losses among S&P 500 stocks, tumbling 3.2% after reports that company founder Andy Bechtolsheim will pay $1 million to settle charges of insider trading brought by the U.S. Securities and Exchange Commission (SEC). As part of the settlement, Bechtolsheim agreed not to serve as a director or officer of a publicly traded company for five years.

After weeks of solid gains that helped push equities indexes to all-time highs, shares of companies engaging with artificial intelligence (AI) stumbled on Wednesday. ServiceNow (NOW) shares fell 2.5%, losing ground after seven straight sessions in positive territory bolstered by the enterprise cloud software provider’s generative AI capabilities. Shares of AI chip giant Nvidia (NVDA) also fell 2.5% amid news of company insiders selling positions in the red-hot stock.

Netflix (NFLX) shares slipped 2.5% after Wedbush removed the streaming service’s stock from its Best Ideas List, predicting a deceleration in subscriber growth. In addition, a judge ruled against Netflix’s bid to dismiss a defamation case related to its “Inventing Anna” miniseries.

[ad_2]

Source link