Gilead Sciences Finally Starts Succeeding (NASDAQ:GILD)

[ad_1]

Sundry Photography

Gilead Sciences (NASDAQ:GILD) has been perhaps one of the most discussed biotech companies as an investment. The company effectively was the first to cure Hepatitis C, capitalizing on an incredibly strong HIV business, before competition hurt its market position substantially.

Since then, the company has become known for massive acquisitions that have struggled to pan out. Despite that, it seems like the times are finally changing. The company is building an exciting new oncology business, and we expect it’ll be able to drive substantial shareholder returns going forward.

Gilead Sciences 2023 Results

The company closed out with a fairly strong 2023, in relation to a market capitalization of just under $94 billion.

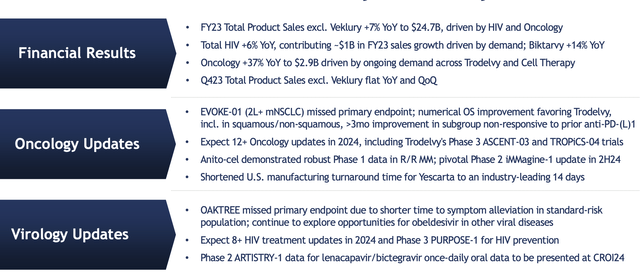

Gilead Sciences Investor Presentation

The company saw total FY23 product sales, excluding Veklury, increasing 7% YoY to almost $25 billion. The company has managed to keep its HIV portfolio incredibly strong, and the company’s oncology portfolio has done well as well. Oncology grew 37% YoY, staggering growth to almost $3 billion. That means it’s finally a double-digit position of the company’s business.

It’s now a strong business in its own right. The company expects significant trial data in 2024, which is exciting to see for Oncology, and it’s also working to expand its manufacturing turnaround, which is incredibly impressive. For oncology, a fast turnaround matters more than anything else.

The company did have a missed endpoint for OAKTREE, but with COVID-19 declining, it’s less important.

Gilead Sciences Business Performance

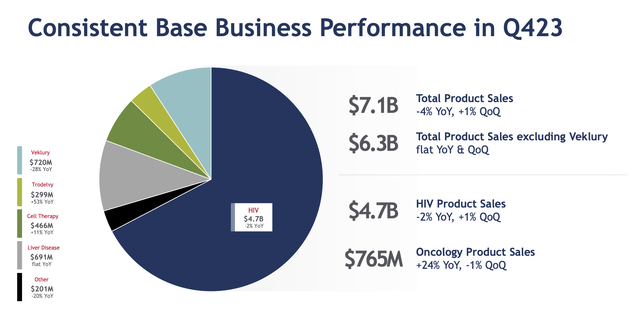

This shows the company’s business performance by segment, which we partially discussed above, in the most recent quarter.

Gilead Sciences Investor Presentation

The company saw $7.1 billion in quarterly earnings, which is a strong way to close out the year. That’s roughly 30% of the company’s quarterly earnings in the last quarter of the year, a great way to finish out the year. The company’s portfolio continues to be carried by HIV, which was 66% of sales for the last quarter, but the company is expanding its other businesses.

Excluding Veklury (COVID-19), the company saw $6.3 billion in revenue, ~90% of its revenue from secure aspects. There is one concerning aspect that the company’s oncology product sales dropped 1% QoQ. Still that’s a lot of quarterly variance, and we expect the company to pick it up in coming quarters.

Gilead Sciences New Businesses

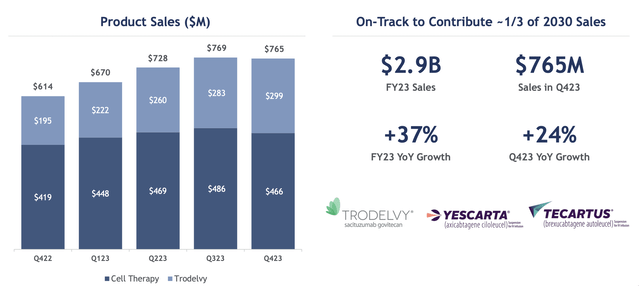

This shows the company’s new businesses. The company is still targeting 1/3 of 2030 sales from this oncology business.

Gilead Sciences Investor Presentation

The company has 4 active clinical trials here and is already at $3 billion almost in outstanding sales. The company is looking for 4 line extensions that it thinks could help out its portfolio here. Trodelvy has officially passed blockbuster status, and while it was an incredibly expensive acquisition, analysts expect >$2-3 billion in annual sales.

The company’s cell therapy business makes billions annually, but the company needs to work to build up capacity due to complexity in manufacturing. We discussed that some above, but the company expects capacity to roughly double to 2026. That could allow the company’s revenue to double in this segment over the next several years.

Gilead Sciences 2024 Milestones

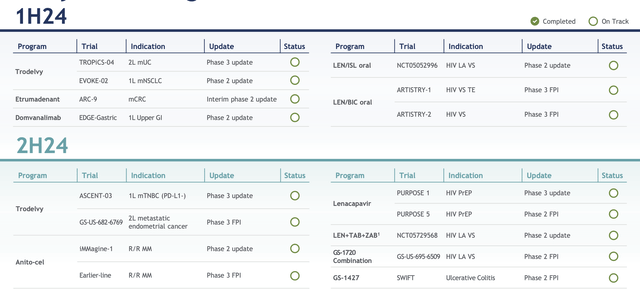

The company has a number of milestones coming in 2024 that we are paying close attention to.

Gilead Sciences Investor Presentation

These include the company’s core growth drug Trodelvy, with a number of Phase 3 updates that could enable the drug to expand its indications are revenue. The company also has some potential Phase 3 approvals for Lenacapavir, the company’s latest HIV drug. That would be some exciting data to see in the second half of the year.

There are also a few readouts here drug combinations, and some of the company’s new drugs. Some like Anito-cel could potentially reach billions in peak sales, however, they’re still very young drugs. Given the company’s prior disappointments in new drugs, we’re avoiding getting to optimistic here.

Gilead Sciences Financials

At the end of the day, with all of the noise above, it comes down to Gilead Sciences’ financial picture.

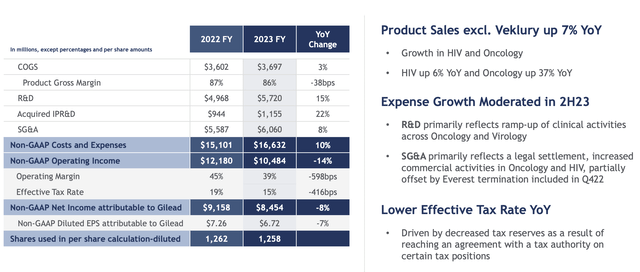

Gilead Sciences Investor Presentation

The company’s COGS has remained strong, supporting high product gross margin. The company’s R&D expenses did go up substantially, resulting in hefty non GAP costs and expenses (up 10% YoY). That led to a 14% decline YoY in the company’s operating income. The company’s net operating margin dropped to less than 40%, which is always disappointing to see.

Still the company has a low valuation. Its outstanding shares went down YoY from 1.262 million to 1.258 million, exciting in a tech world with continued dilution. At the same time, the company’s $74 / share price means its P/E is still a mere 11x despite that drop in income. Investors still don’t believe the company’s story.

That’s not surprising given its recent setbacks. The company is continuing to invest in its future growth with a double-digit R&D increase towards almost $6 billion. We need to see that R&D pan out.

Thesis Risk

The largest risk to our thesis is the company’s ability to grow its new market segments. The company has spent billions of dollars on acquisitions that have turned out to be duds. Even its new oncology portfolio is complex and the company needs to tediously build up both its manufacturing capacity and new customer relationships.

The company has set aggressive goals that might not pan out for the company and its shareholders.

Conclusion

Gilead Sciences’ had an incredibly strong 2023. The company finally started to show the results of its acquisitions, with oncology sales increasing dramatically YoY. At the same time, the company’s HIV portfolio remains unparalleled, as the company continues to release new drugs, despite all of the noise from other companies.

Still, the company has further to go in order to prove itself. The company ramped up R&D spending by the double-digits to almost $6 billion. The company needs that R&D spending to pan out in order to prove its investments and enable it to drive strong long-term shareholder returns. We expect that to pan out with its oncology strength, but overall, we think the company is a strong investment.

[ad_2]

Source link