1 Monster Growth Stock Up 1,500% in 10 Years Is Still a Top Buy in 2024, According to Select Wall Street Analysts

[ad_1]

MercadoLibre (NASDAQ: MELI) is the largest e-commerce company in Latin America, a title that has drawn comparisons to Amazon. But the similarities run deeper. MercadoLibre may not have a cloud computing business, but it has developed an ecosystem of services that support its marketplace and create additional monetization opportunities.

MercadoLibre’s decision to follow the Amazon blueprint has paid off in spades for investors. The stock soared 1,500% over the last decade, compounding at an annual rate of 31%. That means $10,000 invested in MercadoLibre in March 2014 would be worth more than $152,000 today. For context, $10,000 invested in the S&P 500 at the same time would now be worth about $28,000.

Despite that performance, MercadoLibre has a market capitalization of just $75 billion, making it 24 times smaller than Amazon, and select Wall Street analysts still see the company as a worthwhile investment. For instance, Marcelo Santos at JPMorgan Chase and Andrew Ruben at Morgan Stanley selected the stock as a top pick in 2024. Read on to learn more about the so-called “Amazon of Latin America.”

MercadoLibre is the e-commerce market leader in Latin America

MercadoLibre hosts the largest e-commerce and payments ecosystem in Latin America. In every major geography, its online marketplace tops the competition in terms of unique visitors and page views, and it accounts for about 29% of online retail sales across the region. However, Morgan Stanley expects that figure to reach 31% by 2027, meaning the company is still gaining market share.

MercadoLibre’s scale creates a network effect, a virtuous cycle that pulls more merchants and consumers into its ecosystem over time. That happens because each consumer makes the marketplace more valuable for merchants, and each merchant makes the marketplace more valuable for consumers. But much like Amazon, the company supercharges that flywheel with adjacent logistics support, advertising services, credit products, and payment processing.

Those adjacent solutions make its marketplace even more compelling, and MercadoLibre has been very successful across the board. It has the fastest and most extensive delivery network in Latin America, and it ranks as the third-largest digital advertiser in the region. Additionally, its financial services subsidiary (Mercado Pago) is the leading fintech platform in Argentina, Mexico, and Chile as measured by monthly active users, and the second-largest fintech platform in Brazil.

MercadoLibre reported accelerating growth in the fourth quarter

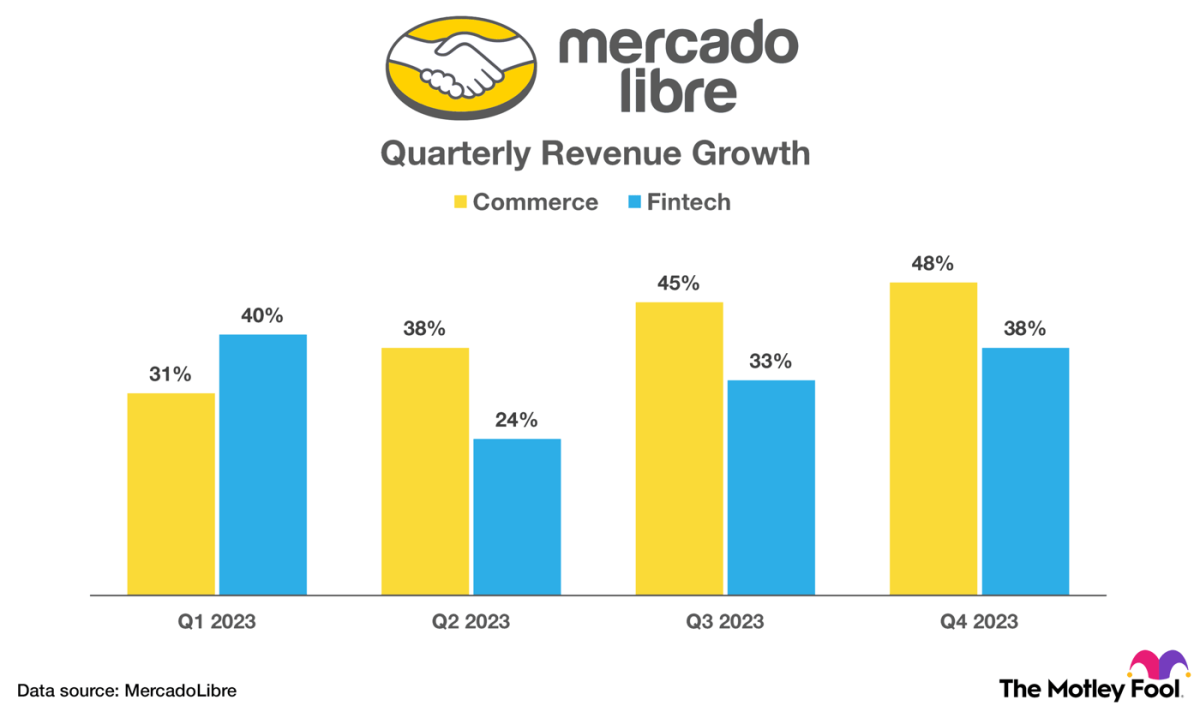

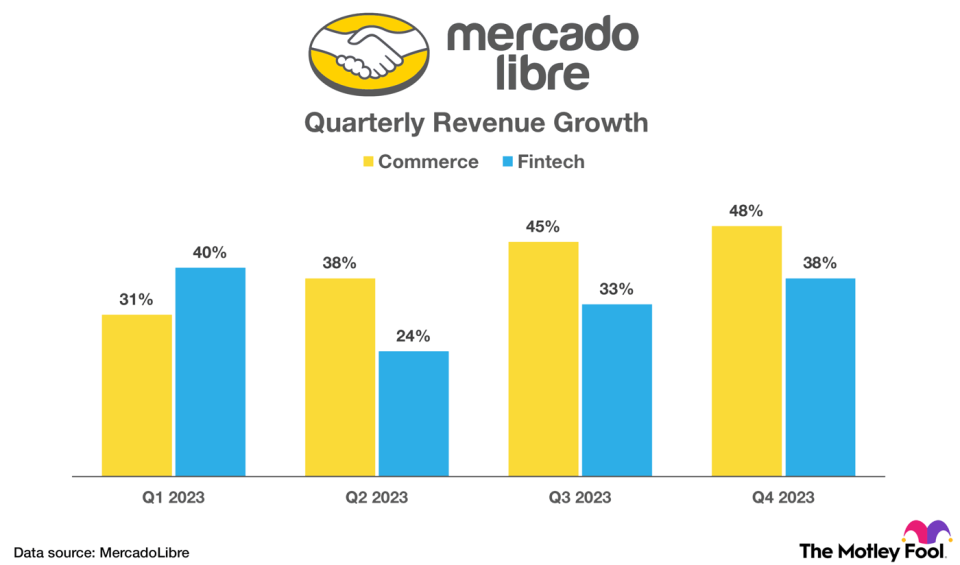

MercadoLibre looked strong in the fourth quarter. Total revenue increased 42% to $4.2 billion, as growth accelerated across the commerce and fintech segments, as illustrated in the chart below. Meanwhile, generally accepted accounting principles (GAAP) net income was flat at $165 million. But that was due to one-time expenses related to tax disputes from 2014 and 2022. Excluding those expenses, net income soared 166% to $383 million.

The chart below shows quarterly revenue growth in the commerce and fintech segments in 2023. Notice that commerce sales accelerated sequentially throughout the year, and fintech sales accelerated sequentially in the second half of the year.

One thing not conveyed by the chart is the momentum MercadoLibre has achieved in certain subsidiaries. Specifically, its logistics network handled a record 94.4% of shipments during the fourth quarter, up from 93.6% last year. MercadoLibre also fulfilled about 50% of shipments during the quarter, up from 43% last year. Finally, advertising services revenue growth has now exceeded 70% for seven consecutive quarters, excluding the impact of foreign exchange rates.

Those numbers indicate that MercadoLibre is successfully deepening its relationship with merchants, meaning the underlying network effect is indeed gaining strength.

MercadoLibre shares are priced reasonably in relation to growth prospects

Going forward, MercadoLibre has three particularly important growth engines in e-commerce, financial services, and digital advertising. To quantify those opportunities, online retail sales are forecasted to grow at 8% annually through 2032, while digital payments revenue is expected to grow at roughly 17% annually through 2031, according to Straits Research. Meanwhile, the digital advertising market is projected to grow at nearly 16% annually through 2030, according to Grand View Research.

To be clear, those are global estimates. Growth in Latin American may be slower given that the regional economy is expected to expand a little less quickly than the global economy, according to World Bank. Investors should also be aware that MercadoLibre generated 22% of its revenue from Argentina last year, while 53% came from Brazil and 21% came from Mexico. I mention that because the Argentine economy is currently suffering from hyperinflation.

That risk notwithstanding, Wall Street expects MercadoLibre to grow revenue at 20% annually over the next five years. But there are a few reasons that estimate could be low. First, the Latin American economy may grow more quickly than expected. Second, MercadoLibre does not yet charge merchants for fulfillment services, meaning it can pull a substantial monetization lever at some point in the future. Finally, eMarketer believes the company will lead the world in ad revenue growth in 2024. That momentum could snowball as MercadoLibre gains clout in retail, much like it has for Amazon.

In any case, the current valuation of 5.4 times sales looks reasonable even if the Wall Street consensus proves correct. Patient investors should feel comfortable buying a small position in this growth stock today.

Should you invest $1,000 in MercadoLibre right now?

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has positions in Amazon and MercadoLibre. The Motley Fool has positions in and recommends Amazon, JPMorgan Chase, and MercadoLibre. The Motley Fool has a disclosure policy.

1 Monster Growth Stock Up 1,500% in 10 Years Is Still a Top Buy in 2024, According to Select Wall Street Analysts was originally published by The Motley Fool

[ad_2]

Source link