Nike Post Earnings: Stay With The Brand (undefined:NKE)

[ad_1]

Thank you for your assistant

Nike (NYSE:NKE) reported their fiscal Q3 ’24 earnings and revenue last Thursday night, March 21, and although both EPS and revenue beat consensus by a healthy amount, the revenue guidance for Q4 ’24 and the first half of fiscal ’25 (begins June 1 ’24) was disappointing.

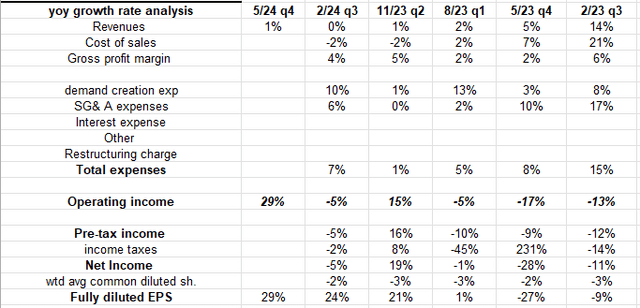

Revenue growth for Q3 ’24 was just 0-1% YoY (depending on whether you use constant currency or cc), operating income was down -5%, but EPS was +24% YoY.

Revenue and operating income had upside surprises of just 1-2%, while the EPS “upside surprise” was 32% (i.e. $0.98 vs. the $0.74 estimate).

Gross margin rose YoY, while operating income slipped, although the EBIT margin (which Nike still uses, and I’d prefer not to), rose YoY.

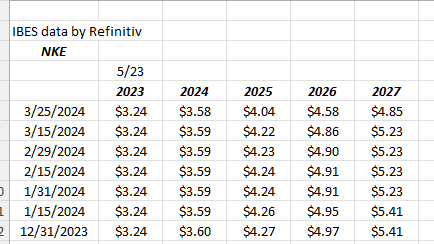

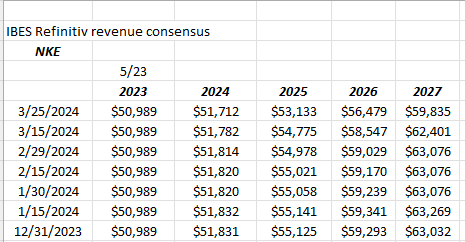

Nike forward EPS and revenue estimates continued to be revised lower after Thursday night’s conference call.

Note the drop in the fiscal ’25 EPS estimate post-earnings.

’25 – ’27 revenue estimates are still dripping lower.

Source: LSEG earnings and revenue estimates

Any Positives to Report?

Nike is facing easy compares for the rest of calendar and a particularly easy compare with their expected fiscal Q4 ’24 quarter ended May ’24:

Because Nike doesn’t report a cash flow statement, the bounce in their free cash flow in this fiscal Q3 ’24 won’t be known until the 10-Q is released in the next few weeks. Nike’s P/L does not break out depreciation or amortization, so a rough estimate can’t be made of Q3 ’24’s cash flow.

Very few analysts ever use “cash flow per share” but as of the November ’23 quarter, Nike printed $4.72 in cash flow per share (CFPS) and $4.12 in free cash flow per share (FCFPS) higher than EPS.

Noting the revenue vs. inventory growth at Nike, which was positive again in the Feb ’23 quarter, we should see another reasonably-strong quarter of free cash flow when the Q is released in a few weeks.

Summary/conclusion: I think it was Jefferies that called Nike’s distribution system “all over the place” as they are struggling with DTC and wholesale, but they will get it worked out.

Readers and expected investors in Nike may not see much upside from the stock – if any – until late in calendar ’24. It’s a large-cap tech and growth stock market, but it’s unlikely Nike will participate in the market rally this year.

The real question is, “Is the brand broken and lost its allure, or is all of this temporary?”

Nike does see fiscal ’25 as the inflection point.

This blog missed the Nike run of the last 10 years since the valuation was always so intimidating (you don’t want to be the last one buying a growth stock before growth slows), so nipping away at the stock down 45% isn’t too worrisome.

The multi-year low in the stock is the low $80s from late ’22, but good technicians tell me Nike has good support at $90.

The valuation is still “salty” as they say, trading at an average P/E for the next few years of 22x, versus the expected EPS growth rate over ’25-’27 of 12–13%, and that’s still with declining EPS and revenue estimates.

Price to revenue is down to 2.2x, versus the +4x valuation near the stock’s peak in late ’21 at $179.

The great thing about a stock like this is when the growth stocks and the market winners are rebalanced, it’s likely Nike won’t have appreciated much, and readers can tuck in a few shares each quarter and wait for the recovery.

This blog is slowly building the position, and it can be frustrating. More has been added to the stock the last few days on the post-earnings weakness.

Nike, Apple (AAPL), Coca-Cola (KO) are still three of the strongest brands in the world, but that doesn’t mean they don’t have problem periods.

None of this is advice or a recommendation. Past performance is no guarantee of future results. Investing can involve loss of principal even over short time frames. All EPS and revenue estimates are sourced from LSEG and all company info is sourced from earnings releases and 10-Qs.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source link