Ambac: Finally Shaking Off The Great Financial Crisis (NYSE:AMBC)

[ad_1]

adamkaz/iStock via Getty Images

Ambac Financial Group (NYSE:AMBC) is an interesting case of a turnaround insurance company. Known as the American Municipal Bond Assurance Corporation decades ago, the 2008 Financial Crisis forced the company into a tight spot, as it has provided guarantee insurance on numerous bonds that went into default. For more than a decade, it has worked to resolve these huge obligations, stay afloat, and evolve its business model.

With FY 2023 results out last month, it’s a good opportunity to assess this company’s situation, and whatever we may think of the business now, I think it’s good learning opportunity.

Financial History

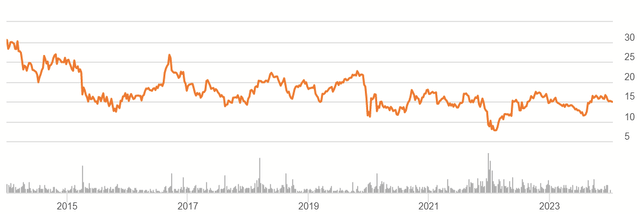

Over the past decade, it’s been a bumpy ride down for AMBC’s share price.

AMBC Price History (Seeking Alpha)

It’s about half where it was before. This isn’t surprising, considering it was a shrinking business that struggled to manage its runoff guarantee line.

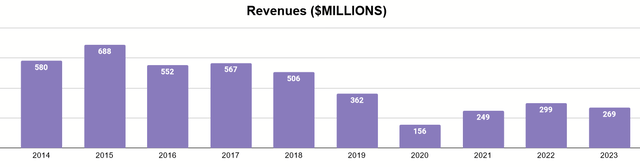

Author’s display of 10K data

Revenues are about half what was possible in the first half of the decade. Meanwhile, the decline of the balance sheet is even more stark.

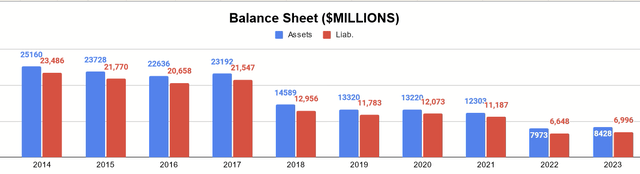

Author’s display of 10K data

By this measure, the business is less than half of what it used to be. Still, a more nuanced look shows an interesting development.

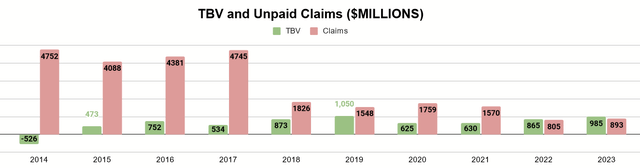

Author’s display of 10K data

Their unpaid claims are substantially lower, while tangible book value actually increased from where it was. TBV actually exceeds their unpaid claims now (something I always like to see with insurance). This shows that the financial position of the company has improved substantially, with lot of risk removed for shareholders going forward. Let’s examine in more detail, though.

Balance Sheet

First thing to check out is the assets.

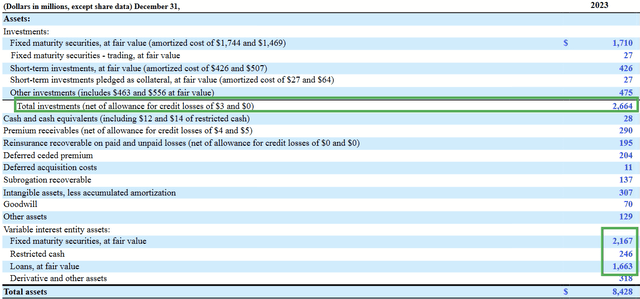

Assets (2023 Form 10K)

The company shows about $2.6 billion in its investment portfolio. A few billion in similar assets are reported through their VIEs. Let’s look at the portfolio proper first.

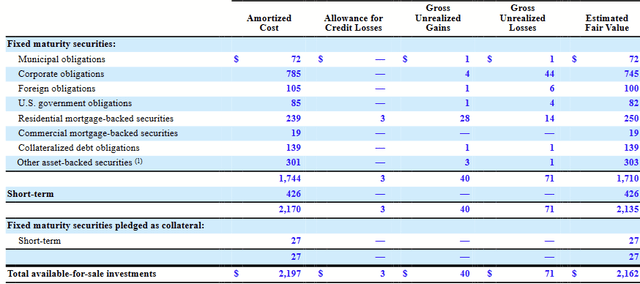

Investment Portfolio (2023 Form 10K)

Most of it is invested in fixed maturity securities, many of which are commercial issues, such as MBSs and CLOs.

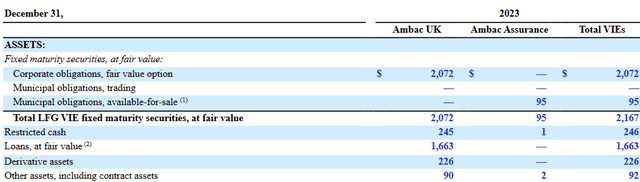

2023 Form 10K

The VIEs represent the legacy guarantee business (2023 Form 10K, pg. 104). As seen above, these have a simpler breakdown but generally lean toward corporate issues as well.

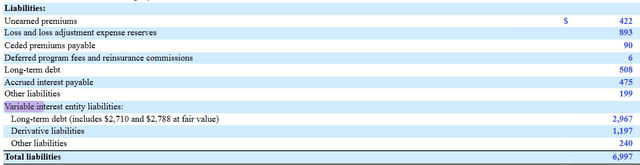

Looking at the liabilities, it should be unsurprising that the larger portion of them come from these VIEs.

Liabilities (2023 Form 10K)

The VIE long-term debt, however, is due after 2030. $519M of the holding company’s long-term debt is due this June, however. With its cash position of $28M, it will likely have to liquidate some of its portfolio to cover this or else refinance at likely a much higher rate.

Overall, the balance sheet appears to be healthy and able to meet upcoming obligations, even if the concentration in non-governmental bonds is less secure.

Business Going Forward

Ambac has transformed and positioned itself to underwrite a different type of insurance: specialty property-casualty. It has three components of its platform to support this new business: Everspan, Cirrata, and Redgrove. (Redgrove accounting for minority stakes in other operations, most of the discussion will be about the other two.)

Q4 2023 Company Presentation

Their reason for the shift is simple. The company wants to move into a line of insurance that it believes doesn’t offer the same level of risk as the old model.

Q4 2023 Company Presentation

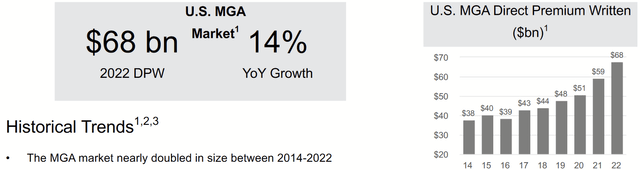

The company notes that the US market has grown substantially over the decade, with $38B in premiums written in 2014 up to $68B by 2022. Believing that demand for these specialty products will continue to rise, they want to ride that wave.

Crucially, though, we need to emphasize that they aren’t just busting into that type of insurance product, but they are focusing on an MGA-driven model for distributing their products. As the company explains in its 10K (pg. 5):

MGA/Us are specialized types of insurance agents or brokers that are vested with underwriting authority from an insurer, administering programs and negotiating contracts on their behalf. This is a particularly useful vehicle for P&C insurers as MGA/Us tend to participate in the E&S market where specialized expertise is needed to underwrite policies.

Additionally, MGA/Us are cost effective means for an insurer or reinsurer to access or grow a particular class of business they find attractive given the MGA/U already possesses product expertise and distribution capabilities.

Q4 2024 Company Presentation

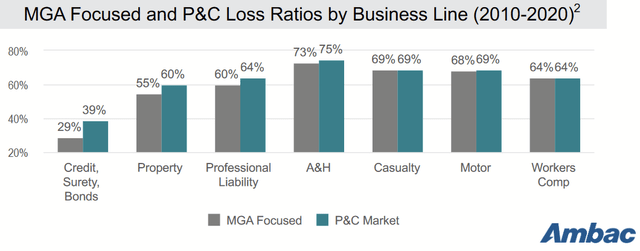

The company cites industry data indicating the better risk profile for MGA. A difference of a few hundred basis points in loss ratios can mean significantly higher margins for shareholders.

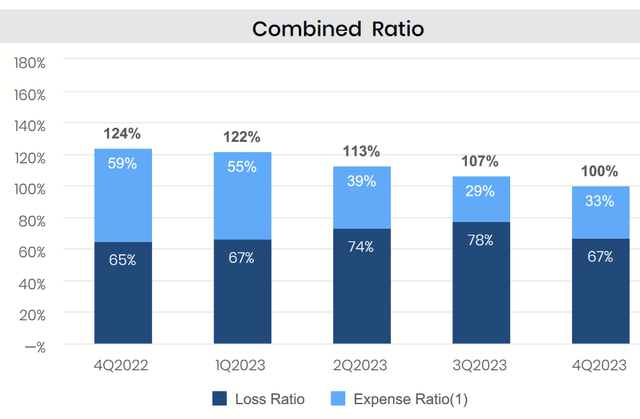

It’s difficult to say much about how well Ambac will deliver on this, as it is still building this business up and scaling it. Yet, 2023 ended with Evergreen decreasing its combined ratio and reaching the milestone of 100%.

Q4 2023 Company Presentation

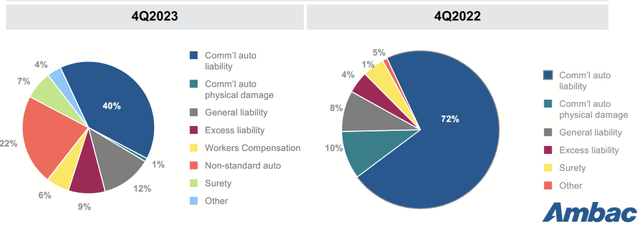

This it did while also increasing the diversification of its insurance products, seen below.

Q4 2023 Company Presentation

We need to talk about the other key component of the platform, though: Cirrata.

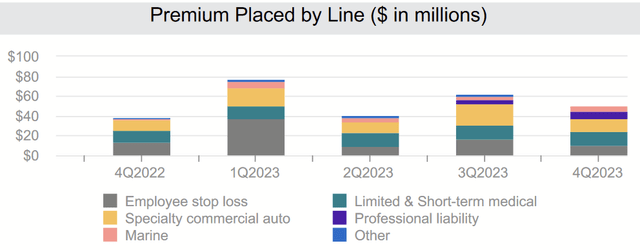

Q4 2023 Company Presentation

Cirrata, meanwhile, does the MGA work itself. Seen above, its subsidiaries provide fee-based earnings from the commissions on its underwriting. Ambac seeks to acquire other MGA businesses (or launch new entities) and add them to the platform. Unlike the insurance products, this component is more capital-light and allows easier, additional growth.

Valuation

There are some challenges here that I need to address. Normally, for an insurance company, I would take tangible book value and add to it ten years’ worth of discounted earnings. With Ambac being so recently turned around, an idea of normal earnings it tricky to determine.

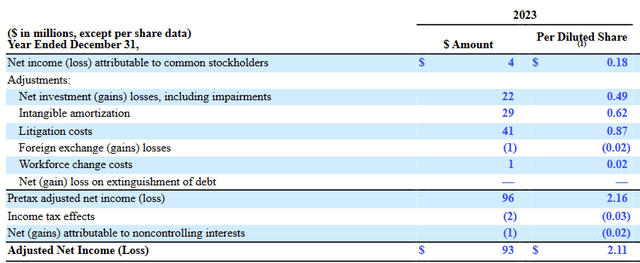

2023 Form 10K

With net income at $4M and Ambac’s adjusted net income at $93, that makes for quite a difference. Many items resolved between the two figures are either non-cash in nature or episodic costs (like litigation). Yet, I believe more time and proof of execution is needed before I attempt to calculate future earnings.

There are a few reasons to be concerned. I think we’re in a middle zone between expectations of rate cuts or further hike, as well as whether or not there will be a recession. A recession could very easily hurt sales and result in a loss of investment income from their corporate-heavy, fixed-income portfolio. Defaults of those issues on their book would also reduce TBV.

TBV stands at $985M for year-end 2023, at $21.79 per share. If nothing else, we can start by saying that $21.79 is a fair value and continue to watch Ambac for improvements and to see if the valuation warrants revision. Considering the market cap is currently $685M, at about $15 per share, that’s a decent discount, with room for plenty of upside if Ambac does everything it intends to do.

Conclusion

Long-term investors know that careful selection matters in the stock market. Ambac has only recently freed itself of the bindings that its poor, pre-2008 business model created for it, and remnants of that model will still appear in their reported results for some time. It’s a sobering echo from the past that reminds us of the importance of due diligence and pickiness on price.

Thankfully, Ambac is fundamentally different company now with a much more practical model. While uncertainties about execution persist, the market has been slow to reward some of the facts, and the shares trade at a discount even for disappointing results going forward. This gives patient investors a decent entry price for even mediocre outcomes, with potential to ride the benefit of killer success.

While I wouldn’t make it my biggest holding, I ultimately think the current facts indicate an attractive risk-reward asymmetry. For that reason, I consider AMBC a reasonable Buy.

[ad_2]

Source link