Cato Corporation: Commercially Doomed But Liquidation Upside Exists (NYSE:CATO)

[ad_1]

AnnaZhuk/iStock via Getty Images

Introduction and thesis

The Cato Corporation (NYSE:CATO) is a leading retailer of women’s fashion and accessories, with a focus on offering affordable apparel and accessories for juniors, misses, and plus-size customers. Founded in 1946, the company operates primarily under the “Cato,” “It’s Fashion,” and “Versona” brands, with over 1,300 stores across the United States.

We do not see a realistic future where Cato is growing in excess of inflation consistently or one in which its brand is gaining value. The industry is incredibly competitive and, to an extent, is victim to changing consumer trends. To offset this, brands spend a considerable amount on marketing and are also usually part of a diversified conglomerate. Cato does not benefit from either, lacking the financial ability to invest in its brand.

We believe its near-term performance will continue to be poor, while it may return to below-inflation growth as economic growth pushes the business forward. This will not generate alpha for the business as it has lost the scale needed to generate healthy margins.

Whilst slightly pessimistic commercially, we believe an orderly liquidation is potentially the best option for realizing upside. As we do not believe this will happen, we rate the stock a hold.

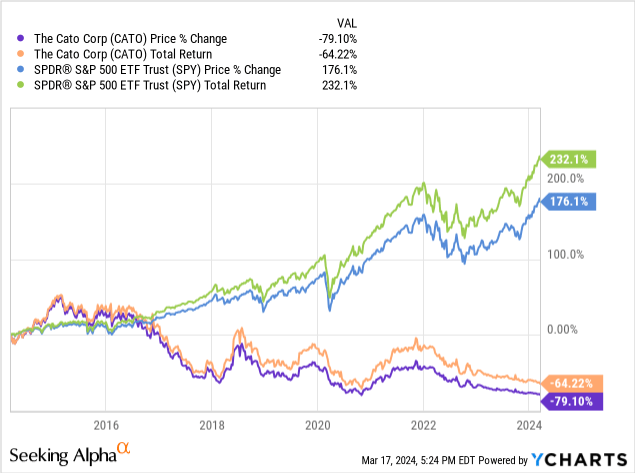

Share price

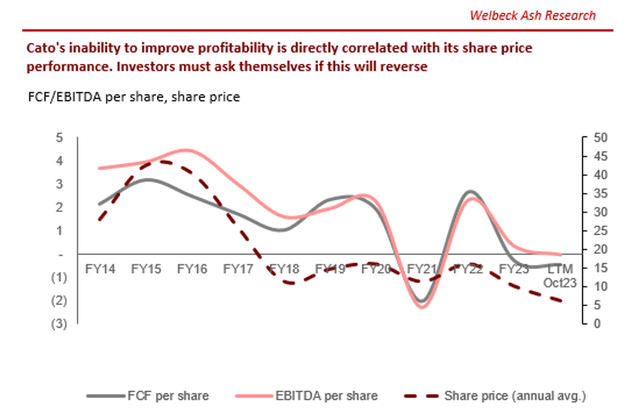

Cato’s share price performance has been disappointing, losing over 60% of its value during the last decade. The company’s industry has experienced considerable disruption during this period and Cato has failed to adapt, being left behind.

Commercial analysis

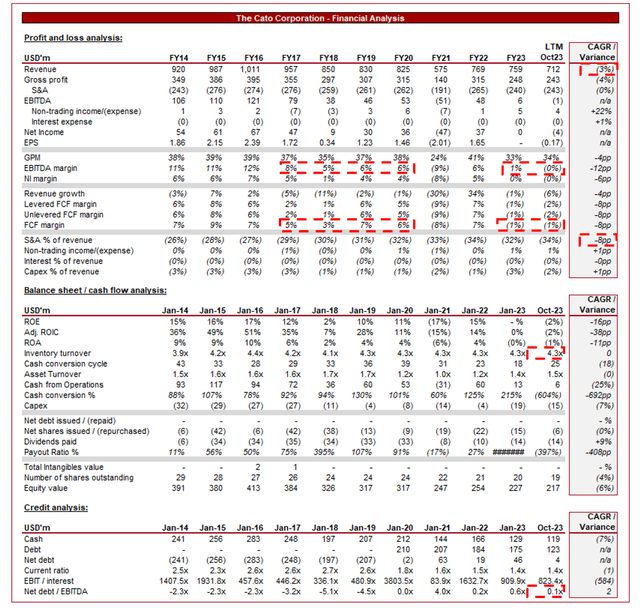

Capital IQ

Presented above are Cato’s financial results.

Cato’s revenue has declined persistently during the last decade, with a CAGR of -3%. During this period, it experienced 8 periods of negative growth, still remaining below its pre-pandemic revenue levels.

Its profitability has broadly followed suit, particularly post-FY20, struggling to balance commercial development and profitability.

Business Model

Cato operates a chain of retail stores specializing in women’s apparel, shoes, and accessories. The company targets middle-income women, offering trendy and affordable clothing options. Cato currently operates ~1,245 stores across the United States, typically located in strip malls and shopping centers, albeit has been retreating from low-profitability locations following a peak of over 1,300 stores.

Cato focuses on providing value to its customers by offering fashionable clothing at competitive prices. It offers a broad assortment of apparel and accessories, including casual wear, formal attire, activewear, footwear, and accessories. Cato seeks to frequently refresh its product offerings to align with changing fashion trends and customer demands.

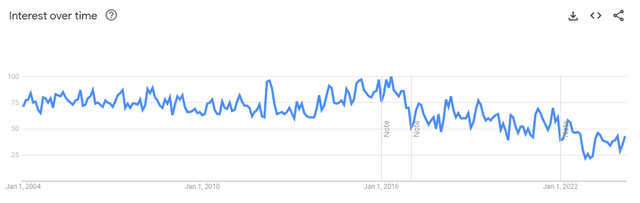

The company’s revenue generation per store may be the lowest we have ever seen, with ~$572k per location based on its LTM23 revenue and closing number of stores. Consumers have appeared to lose interest in Cato’s offering, likely as a result of a combination of factors. The company’s relative size means its ability to market to customers is far smaller than its larger peers. Secondly, the business has suffered from the rise of fast fashion (such as Zara and H&M), as well as faster fashion (such as Shein and PLT), contributing to increased competition and an inability to innovate at the pace these firms can. The company’s brands are no longer cool and its products do not resonate with consumers. This is perfectly illustrated in the below graph, with interest peaking in 2016 (at the same time as revenue).

The company has relied far too heavily on traditional marketing channels and promotional strategies to drive foot traffic to its stores and increase sales. Whilst its peers have a strong social media presence and access to related channels, Cato is reliant on footfall and low-conversion segments. This is a 2010 company operating in 2024.

Many of the traditional apparel retailers have struggled to transition to e-commerce, which is the secondary trend impacting this industry during the last decade. Cato has failed in its efforts to adapt, likely due to an ill-fated focus on trying to shore up its retail presence. Revenue from e-commerce is currently less than 10% of total revenue, while its core customer base continues to age and it loses out on capturing a new audience, which has a preference for e-commerce.

Financials

Cato’s recent performance has been poor, with top-line growth of +1.6%, -7.1%, -7.1%, and -10.4% in its last four quarters. In conjunction with this, its margins have improved.

The recent decline is a reflection of the broader economic conditions in our view. With an extended period of elevated inflation and interest rates, consumers have experienced an attack on living costs, contributing to a softening of discretionary spending. Wage inflation has likely been a major factor protecting against a complete decline in spending.

FRED

This said, we do not believe the entirety of its downturn can be assigned to macro-conditions. The company, despite its deep decline in FY22, appears overly sensitive to conditions, implying a further decline in its competitive position, alongside the reduction in store count (~44 closed YTD).

The company’s margins are likely a reflection of its falling towards its operational breakeven in our view, rather than an investment in growth. With such low revenue generation per store, the company is genuinely struggling to cover its fixed costs.

Balance sheet & Cash Flows

It is worth highlighting that Cato is conservatively financed, allowing to it buy back shares and eliminate any solvency concerns. While this has helped stem the bleeding share price-wise, this capital could likely have been better allocated to reinvestment.

Industry analysis

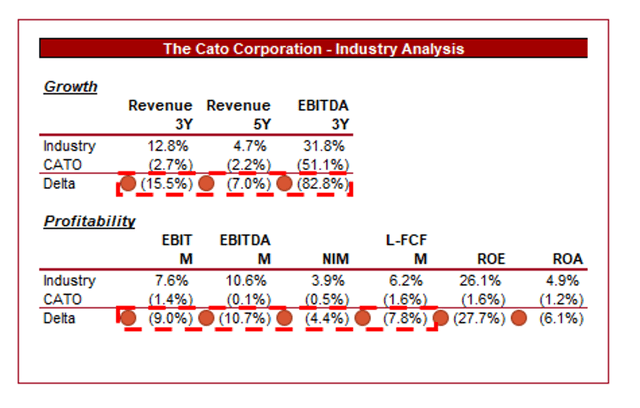

Seeking Alpha

Presented above is a comparison of Cato’s growth and profitability to the average of its industry, as defined by Seeking Alpha (26 companies).

Unsurprisingly, Cato disappoints relative to its peers. The company has considerably lower growth and poor margins, reflecting a loss in market share and its underperformance despite market conditions, which are impacting all its peers.

The business is fundamentally weak. It is not a takeover target due to its margins and limited brand value. The only commercial value we see is its existing footprint across the US.

Valuation

Capital IQ

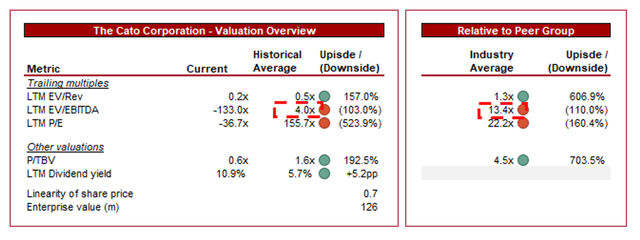

Cato is currently trading at 0.2x LTM revenue. This is a considerable discount to its historical average.

Cato’s valuation is completely depressed, incomparable to its historical average or peer group. We do not see any realistic route to commercial relevance, the competition is far too high, it lacks sufficient financial resources, and just appears too far behind.

Instead, any value will come from either a takeover or an orderly liquidation. The former is not realistic in our view, as we do not see what Cato can offer, albeit a continuation of its decline could make it a takeover possible purely to access 1,245 stores easily.

An orderly liquidation could yield value. The company currently has:

- $119m of cash.

- $31m of accounts receivable.

- $99m of inventory.

- $190m of PPE.

We will assume all other assets cannot be settled in cash (Deferred tax assets, prepaid and restricted assets, and other long-term assets of $48m).

Against this, the business has claims of:

- Payables and other current liabilities of $133m.

- Lease commitments of $123m.

We will assume all other liabilities do not need to be settled in cash (Other non-current assets of $14m).

This suggests a liquidation valuation of at least $183m (vs. equity of $217m at Oct23), albeit could easily be higher due to how PPE is currently being valued and the potential to sell intangible assets (such as its brands and the privilege of taking its 1,245 stores in one package).

This implies upside at a market cap of ~$121m (+51%), although does not reflect the period of time until which the business is hypothetically liquidated. Currently, Cato is burning cash due to negative FCFs and Management has no intention to liquidate the business, requiring a discount to reflect this.

Capital IQ

Key risks with our thesis

The risks to our current thesis are:

- Economic Volatility – Economic downturns and fluctuations in consumer spending patterns will impact discretionary spending on apparel, affecting sales and profitability.

- Intense Competition – Intense competition within the retail industry, including price competition and aggressive promotional activity, will only continue to pressure margins and market share.

- Misallocation of capital – Cato can be liquidated for upside currently but this may not be the case if its equity is misallocated. An elimination of this buffer would immediately justify a sell rating.

Final thoughts

We do not believe Cato is a good business, and it’s a worse investment. The company has become irrelevant in a highly competitive industry, where brand and consumer interest are everything. The company provides no utility and has no reason to exist beyond discretionary interest, which continues to decline.

We believe it is very unlikely Cato will ever generate persistent, industry-comparable growth in consumer interest, let alone revenue growth, damning it to a slow decline as stores are closed and any operating leverage evaporates. We do not believe it is sufficient just to generate LSD revenue growth when inflation could easily track at 2-3% in the coming decade.

We believe Management should liquidate the business and attempt to sell its brands, as this should allow for shareholder upside based on its current market cap. As we do not believe this will actually occur, we rate the stock a hold.

[ad_2]

Source link